Owners of early 1985 classics struggle with VED exemption despite supposedly being eligible

Owners of classics have been struggling to get their cars changed to the historic tax class, despite supposedly being eligible for VED exemption.

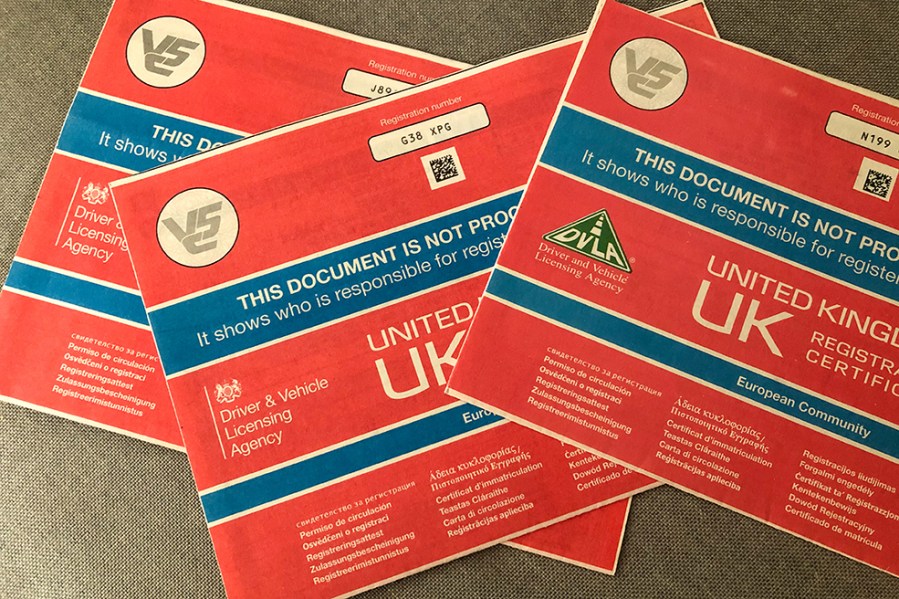

The rolling 40-year exemption is applicable if the V5C registration certificate (log book) in your name shows the vehicle was made, or first registered, before January 1 more than 40 years ago. This means that, from April 1, classics registered in 1984 could be in the historic tax class and be exempt from VED. However, DVLA also states that if the V5C shows that the vehicle was registered between January 1 and January 7 more than 40 years ago, it can still be registered as a historic vehicle, as it is assumed the vehicle would have been made in the previous year.

In theory, this means that cars registered in the first week of 1985 can also be VED exempt. In practice though, it’s been more difficult for several owners. Graham Pearson is the owner of a Mini 25 LE registered on January 1, 1985, yet was declined at two post offices when attempting to change his vehicle to the historic tax class. He was advised to call DVLA, which told him that he need to provide proof of the year of manufacture, despite the registration date on the V5C falling within the correct parameters. Apparenty, DVLA didn’t have the car’s build date, so automatically set it to a default of 1985. Graham was told he needed to get proof of year of manufacture in the form of a stamped document from the manufacturer and send that with the V5 to DVLA.

“As my car was registered on the road on January 1, 1985, there’s no way it could have been built after that,” he told us. “The trouble is, the post office staff and DVLA staff are only doing what the computer tells them.”

Gavin Bushby had a similar experience. His Talbot Salora was registered on January 2, 1985, so should be treated as per a 1984 car. However, the Post Office could not change the tax class, and after half an hour on hold to DVLA, Gavin was informed that it was impossible to tax.

Gavin Bushby was initially foiled when trying to change his Talbot Solara to the historic tax class

“They did not have an exact build date from Talbot so therefore completed their records as made on December 31, 1985,” he explained. “They fully agree it can’t have been made a year after it hit the road, but the computer says no! They also agree it is tax exempt, but the computer says no!”

As instructed, Graham and Gavin both sent their V5 to DVLA to be amended. A DVLA spokesperson said: “In these two cases, as evidence of date of manufacture was not provided at the time the dates of manufacture defaulted to December 1985. Colleagues have now corrected the records and new V5Cs will be issued to your readers to allow them to tax in the historic tax class at their nearest Post Office.”

Problem solved? Not quite yet, it seems. Both parties received a new V5, but the tax class remained PLG rather than Historic. “I’ve now got to once again go down to a Post Office with the V5 signed (again) and another V112!” said Gavin. After 25 days there’s still no progress.”

And the same went for Graham, who wrote a letter to DVLA explaining the situation and included an email from British Motor Industry Heritage Trust stating the date of manufacture as the third week in August 1984. “I received the new V5, but with no return letter,” he explained. “I went back to the local post office but the computer is saying no to the free tax because the V5 is still PLG. The guy on the counter has written historic on the V5 and sent it back to DVLA. So at the moment I’m waiting to see what is returned.”

DVLA guidance suggests a dating certificate from a club is not enough evidence to get a date changed if you think the age of your vehicle shown is wrong. It says that you need to provide “an extract from the manufacturer or factory record, or from the appropriate ‘Glass’s Check Book’ that specifically links to your vehicle’s original identity. This must be supported by a covering letter from the relevant vehicle owners’ or enthusiasts’ club. Dating certificates from a vehicle enthusiast’s club are not acceptable to change the date of manufacture for an already registered vehicle.”

Have you had issues with trying to get your vehicle in the historic tax class? Let us know via classics.ed@kelsey.co.uk