More and more owners are borrowing money against their classics – according to alternative finance firm HNW Lending.

The firm recorded a 35 per cent increase between last October and this March compared to the same period six months previously, itself a 27 per cent jump from figures released a year earlier (October 2015 to March 2016).

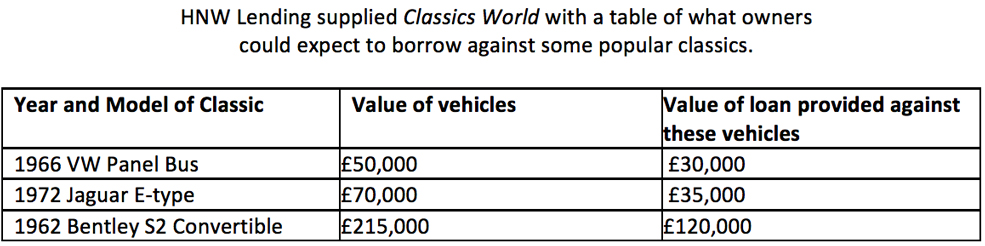

Selling loans in the £50,000 to £2million range, HNW Lending has provided loans to date worth over £1 million against classic cars, with the biggest being £150,000 against a three car collection comprising a 1939 Lincoln Zephyr, a Porsche 911 and a 1957 VW Samba.

Ben Shaw, founder and director of HNW Lending said: “We are very happy to lend against classic cars because they are easier to validate as genuine when compared to other valuable assets, and because they have been rising in value. This means any potential risk we face in terms of repayment defaults, is lower than in other areas.”

Ashley Maddox, co-founder of AG Classic Automobiles added: “They are one of the best value assets you can own and many of our clients are looking to make investments here and diversify away from stocks and shares.”

We’ve already seen ‘log book loans’ for lower value cars; how long before hard up owners of classics at the bottom end of the price spectrum are tempted by lenders?